Kyle auto title loans offer fast cash using your vehicle's title as collateral, but hidden costs and repossession risks exist. Carefully review terms, understand fees, compare offers from multiple lenders, align repayment plans with income, and prioritize emergency funding for sustainable financial decisions.

In the financial landscape of Kyle, auto title loans have emerged as a popular option for quick cash. However, beyond the initial appeal lies a web of hidden fees that can significantly impact borrowers. This article aims to demystify Kyle auto title loans by first explaining their fundamental structure. We then delve into deciphering concealed costs and equip readers with strategic insights to avoid financial shocks. By understanding these intricacies, borrowers can make informed decisions regarding Kyle auto title loans.

- Understanding Kyle Auto Title Loans: Unveiling the Basics

- Decoding Hidden Fees: A Closer Look at Costs

- Strategies to Avoid Unnecessary Financial Surprises

Understanding Kyle Auto Title Loans: Unveiling the Basics

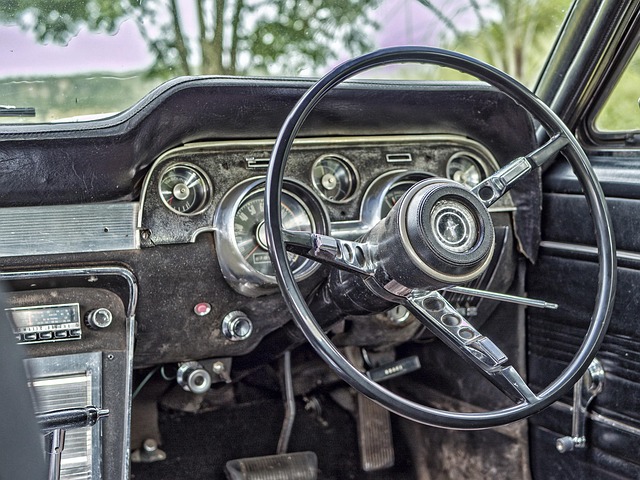

Kyle Auto Title Loans serve as a convenient financial solution for individuals seeking quick access to cash. This type of loan utilizes the title of your vehicle as collateral, allowing lenders to offer faster processing times compared to traditional loans. The process involves providing the lender with your vehicle’s registration and proof of ownership, after which they’ll hold onto these documents until the loan is repaid. Repayment typically occurs over a shorter period, often ranging from 30 days to a year, and borrowers can choose to either keep their vehicles or sell them back to the lender at the end of the loan term.

While Kyle Auto Title Loans offer benefits like fast funding and flexible repayment terms, it’s crucial to understand the associated fees and potential risks. Unlike Houston Title Loans or Fort Worth Loans, these loans carry hidden costs such as interest rates, administrative charges, and early repayment penalties that can significantly impact the overall cost of borrowing. Additionally, failing to repay on time could lead to repossession of your vehicle, underscoring the importance of careful planning and a solid repayment strategy, especially when considering them for debt consolidation purposes.

Decoding Hidden Fees: A Closer Look at Costs

When considering a Kyle auto title loan, it’s essential to look beyond the advertised interest rates and understand the full cost picture. Many lenders hide fees within their terms and conditions that can significantly impact your overall repayment amount. These hidden costs often include documentation charges, administrative fees, and even insurance requirements. By scrutinizing these additional expenses, borrowers can make informed decisions and avoid unexpected financial surprises.

Decoding these fees involves carefully reviewing the loan agreement and understanding the title transfer process. Lenders may charge various fees for transferring ownership of your vehicle’s title, processing paperwork, or providing necessary services. Moreover, exploring different repayment options can also help mitigate these costs. Some lenders offer flexible repayment plans or discount rates for prompt payments, ensuring borrowers pay only what’s fair while navigating the title loan process.

Strategies to Avoid Unnecessary Financial Surprises

When considering Kyle auto title loans, one of the best strategies to avoid financial surprises is to thoroughly research and understand the terms and conditions before signing any agreements. These loans, while offering quick access to emergency funding or fast cash, often come with hidden fees that can significantly increase the overall cost. Make sure you ask about all potential charges, including application fees, interest rates, and any additional costs associated with repaying the loan on time or late.

Another effective approach is to compare offers from multiple lenders in Kyle. Different institutions may have varying fee structures, so shopping around allows you to find the most favorable terms for your situation. Additionally, consider the purpose of the loan as an emergency funding option rather than a quick fix. Repayment plans that align with your income and expenses can help prevent spiraling into debt, ensuring you get the fast cash without long-term financial strain.

When considering a Kyle auto title loan, it’s crucial to be aware of potential hidden fees that could impact your financial health. By understanding the costs associated with these loans and employing strategies to avoid unnecessary surprises, borrowers can make informed decisions. Remember, transparency is key in navigating any loan process, so always scrutinize the terms and conditions before signing on the dotted line.