Kyle auto title loans provide quick cash for those with bad credit, using vehicle titles as security. Eligibility requires a clear title, valid ID, and repayable ability. Loans have fixed interest rates and repayment periods (30 days – 1 year). Strategically use them for debt consolidation, aligning terms with budget and vehicle maintenance. Understand potential consequences of default.

“Exploring Kyle Auto Title Loans: Your Comprehensive Guide. In today’s financial landscape, understanding short-term loan options is crucial, especially in dynamic cities like Kyle. This article delves into the intricacies of Kyle auto title loans, offering a clear understanding for borrowers. From basic concepts to eligibility requirements and repayment strategies, we empower you with knowledge. Learn how these secured loans work, what qualifications are needed, and effective management tips. Navigating Kyle auto title loans has never been more transparent.”

- Understanding Kyle Auto Title Loans: Basics Explained

- Eligibility Criteria for Secure Borrowing

- Repayment Terms & Strategies for Borrowers

Understanding Kyle Auto Title Loans: Basics Explained

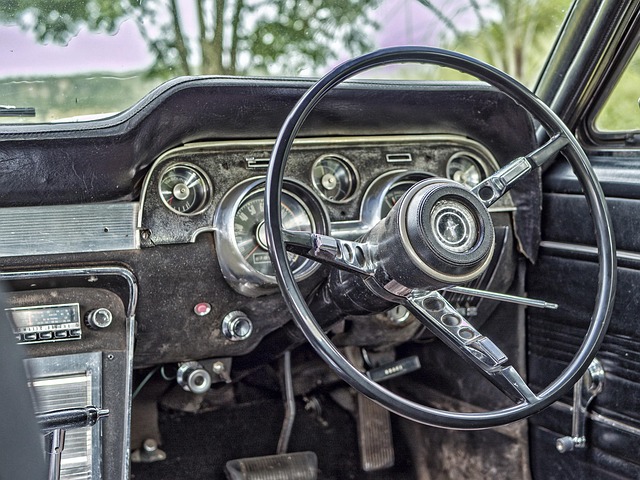

Kyle auto title loans are a type of secured lending where your vehicle’s title acts as collateral for the loan amount. This means that if you fail to repay the loan according to the agreed-upon terms, the lender has the legal right to repossess and sell your vehicle to recover their losses. Despite this risk, many individuals opt for Kyle auto title loans due to their accessibility, especially for those with bad credit or no credit at all. The process typically involves assessing the value of your vehicle, verifying your identification, and establishing a repayment plan that aligns with your financial capabilities.

Lenders consider various factors when evaluating loan eligibility, including your vehicle’s make, model, year, overall condition, and current market value. While this may seem stringent, it ensures responsible lending practices. Moreover, unlike traditional bank loans or bad credit loans, Kyle auto title loans can be a suitable option for individuals who might not qualify for other types of financing due to their credit history or lack thereof. However, borrowers must be mindful of the potential risks and ensure they fully comprehend the loan terms before securing their vehicle as collateral.

Eligibility Criteria for Secure Borrowing

When considering a Kyle auto title loan, understanding the eligibility criteria is essential for borrowers looking for a quick financial solution. These loans are designed for individuals with a clear vehicle title, offering an alternative to traditional bank loans. Borrowers can access funds by using their vehicle as collateral, making it a viable option for those in need of immediate cash. The process typically involves providing proof of ownership and verification of certain criteria.

Eligible borrowers must be 18 years or older, have a valid driver’s license, and demonstrate the ability to repay the loan. While truck title loans are also available under this category, lenders will assess the vehicle’s overall condition and value, ensuring it meets their security standards. Loan terms vary depending on the lender and the borrower’s capacity to pay, but typically range from several months to a year, providing a flexible repayment period for borrowers.

Repayment Terms & Strategies for Borrowers

When considering a Kyle auto title loan, understanding your repayment terms is crucial for managing your debt effectively and maintaining your vehicle ownership. These loans are typically structured with a fixed interest rate and a specific repayment period, usually ranging from 30 days to a year. Borrowers can choose to make full repayment at once or spread payments over time, but it’s essential to stay on top of schedule to avoid penalties.

A strategic approach to repaying your Kyle auto title loan can help you consolidate debt and improve your financial health. One popular strategy is to use the proceeds for debt consolidation, especially if you have high-interest credit cards or other loans. By combining these debts into a single payment, you may save on interest charges and simplify your budget. However, ensure that the new loan terms align with your ability to make payments without compromising your daily needs and vehicle maintenance.

When considering a Kyle auto title loan, understanding the basics, eligibility requirements, and repayment strategies is key to making an informed decision. By familiarizing yourself with these aspects, you can navigate the process smoothly and ensure a secure borrowing experience. Remember, responsible borrowing involves adhering to the terms and having a clear strategy for repayment, allowing you to maintain financial stability while accessing much-needed funds. So, whether you’re a Kyle borrower looking to consolidate debts or cover unexpected expenses, armed with this knowledge, you can confidently take the next step towards securing a loan that suits your needs.