Kyle auto title loans offer quick cash using your vehicle as collateral, bypassing strict credit checks. Borrowers keep their vehicles but face repossession risks and high-interest rates if they default. The simple application process involves providing documents, filling out forms, and eligibility assessment based on income and vehicle value. Early repayment is penalty-free, but extensions may incur fees. Thorough understanding of terms is crucial to avoid financial strain.

“Looking for a quick financial solution in Kyle? Discover the ins and outs of Kyle auto title loans, a unique lending option tailored to car owners. This comprehensive guide breaks down the basics, benefits, and potential risks, ensuring you make informed decisions. We provide a step-by-step application process specifically for Kyle residents, making it easier than ever to access funds using your vehicle’s equity. Explore these options wisely and understand the impact of Kyle auto title loans before securing your loan.”

- Understanding Kyle Auto Title Loans: Basics Explained

- Benefits and Risks: Weighing Your Options

- How to Apply: A Step-by-Step Guide for Residents

Understanding Kyle Auto Title Loans: Basics Explained

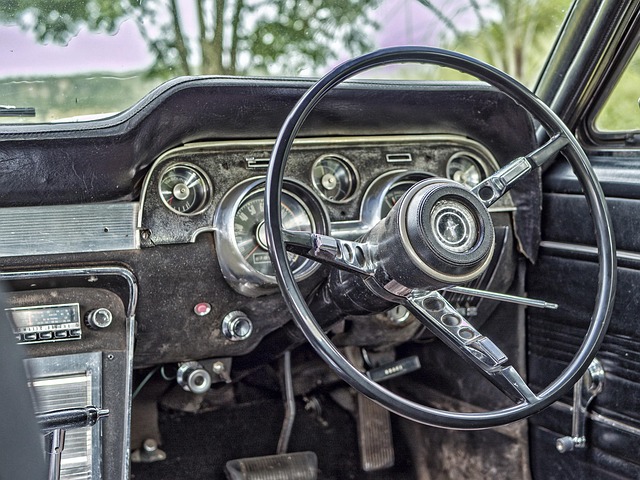

Kyle auto title loans are a financial solution that allows individuals to borrow money using their vehicle’s title as collateral. This type of loan is designed for those in need of fast cash, offering a quick and convenient way to access funds. Unlike traditional loans that require extensive paperwork and credit checks, Kyle auto title loans focus on the value of your vehicle rather than your credit history.

The process typically involves providing the lender with your vehicle’s title, proof of insurance, and a valid driver’s license. Lenders will then assess the value of your car to determine the loan amount. One key aspect is that you retain possession of your vehicle during the loan period. Additionally, if you decide you no longer need the funds or can pay off the loan faster, you have the option to pay it off early without penalties, although fees may apply for loan extensions.

Benefits and Risks: Weighing Your Options

When considering Kyle auto title loans, it’s crucial to weigh both the benefits and risks involved. On the plus side, these loans can offer quicker access to financial assistance compared to traditional bank loans. This can be particularly beneficial for those in urgent need of cash, such as during unexpected expenses or emergencies. The approval process is often faster because it relies less on strict credit checks, making it accessible even to individuals with poor credit scores.

However, there are risks associated with Kyle auto title loans. Since the loan is secured by your vehicle’s title, failure to repay can result in repossession of your car. Additionally, these loans typically have higher interest rates and shorter repayment periods, which may lead to a cycle of debt if not managed properly. It’s essential to ensure you understand the terms and conditions before taking out such a loan to make an informed decision that aligns with your financial goals.

How to Apply: A Step-by-Step Guide for Residents

Applying for a Kyle auto title loan is a straightforward process designed to help residents access quick funding using their vehicles as collateral. First, gather all necessary documents, including your vehicle’s registration and proof of insurance. Then, visit a trusted lender offering Kyle auto title loans or apply online through their secure platform.

Next, fill out an application form with your personal details, such as name, address, and employment information. Provide accurate data for the lender to assess your eligibility based on your income and vehicle valuation. After submission, a representative will review your application and contact you for further discussion. This step-by-step guide ensures a smooth process, making it easier for residents to secure the funds they need through secured loans like Kyle auto title loans or specialized options like semi truck loans.

Kyle auto title loans can offer a quick financial solution for residents in need of cash. By leveraging the equity in their vehicles, borrowers can access funds with relative ease. However, it’s crucial to weigh both the benefits and risks before applying, ensuring you understand the terms and conditions completely. If you decide Kyle auto title loans are the right choice, follow our step-by-step guide for a smooth application process. Remember, responsible borrowing is key to avoiding potential pitfalls associated with such loans.